This week we will try to analyze tax evasion and tax moral in Kosovo from businesses’ perspective. The data have been derived from a survey conducted by Riinvest Institute in the current year with 600 Kosovar businesses, mainly small and medium-sized businesses.

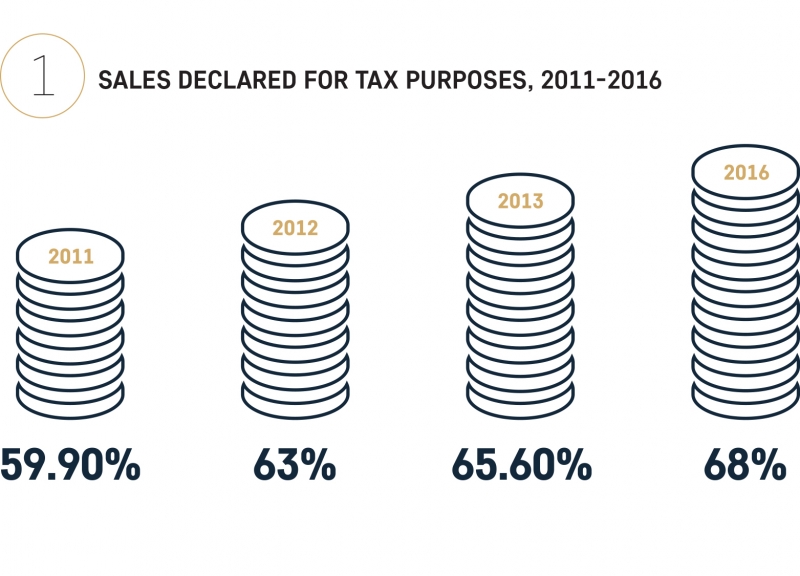

To understand tax evasion, businesses were asked to provide their assessment of the level of sales declared by competing firms for tax purposes. The undeclared percentage (from the maximum possible percentage of 100%) indicates the level of tax evasion. The indirect surveying method has been shown to be the most appropriate in order to obtain information from businesses about the level of tax evasion. Managers/business owners that were surveyed stated that on average businesses in their industry declare around 68% of the revenues. As a result, about 32% of revenues are not declared for tax purposes. Similar results were achieved in the SME survey conducted by Riinvest Institute in 2013, where the percentage of sales declared was 65.6%. Compared to 2013, the level of informality has fallen by only 2 percentage points (Figure 1). Such a high percentage of tax evasion means that businesses contribute less than they need to the national budget and as a result public services that could be funded by business contributions are for one third smaller than they could be. Furthermore, such a level of tax evasion creates inequalities and unfair market competition and can therefore push other businesses to bankruptcy or the same businesses can be incentivized to find similar ways to under declare sales for taxation purposes.

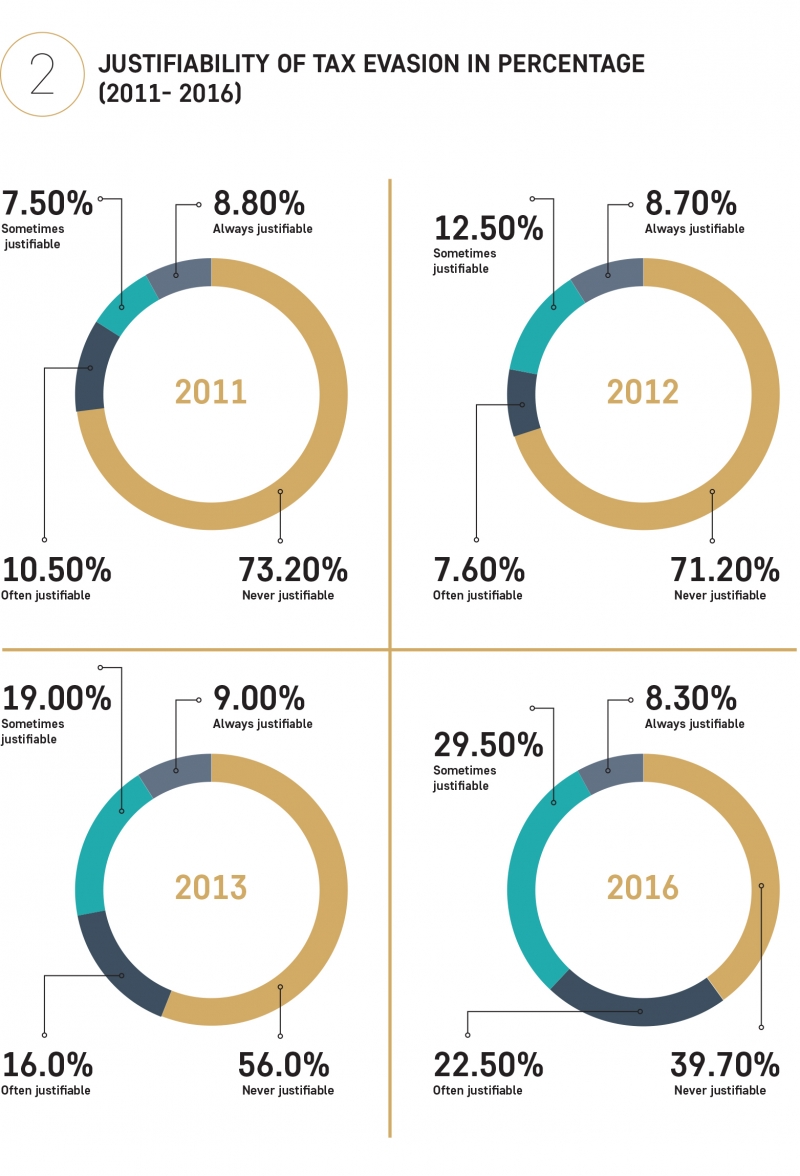

But, to what level do business representatives justify under declaration of sales for tax purposes when there is the opportunity to do so? Through this question Riinvest Institute team has tried to understand the level of tax morale. The question has been assessed from 1 to 10, where 1 means that not declaring sales is never justifiable, while 10 means it is always justifiable. The average assessment turned out to be 4.1 points. If the results of this question are presented in percentages, it can be seen that 40% think that tax evasion is never justifiable; about 30% think that it is sometimes justifiable; 22% think that tax evasion is often justifiable; while 8% think that fiscal evasion is always justifiable. Such results show that around 60% of businesses justify tax evasion in one way or another. Compared to year 2013, there are significant changes since in that year around 56% of businesses stated that tax evasion is never justifiable and around 44% justified tax evasion in one way or another (Figure 2 presents the attitude of businesses regarding tax morale in the last 4 years). If positive extremes are compared, i.e. respondents who never justify tax evasion, Kosovo with 40% ranks far from Slovenia (as the nearest place for which comparative data exist) with 70.3% declaring that tax evasion is never justifiable. Kosovo is ranked among the countries with low tax mores such as Algeria (35%), South Africa (35%), Rwanda (32%) and Iraq (32%) (World Value Surveys, 2016).[1]

____________________________________

[1] The data from the survey enable us to compare the tax morale of businesses in Kosovo with individual tax morale worldwide, using data from World Value Surveys (WVS). Of course, the assumption here is that individual tax morale can serve as a proxy for business tax morale. Data from WVS cover surveys in 56 countries worldwide in periods between 2010- 2014 (note, not all surveys are conducted at the same time).