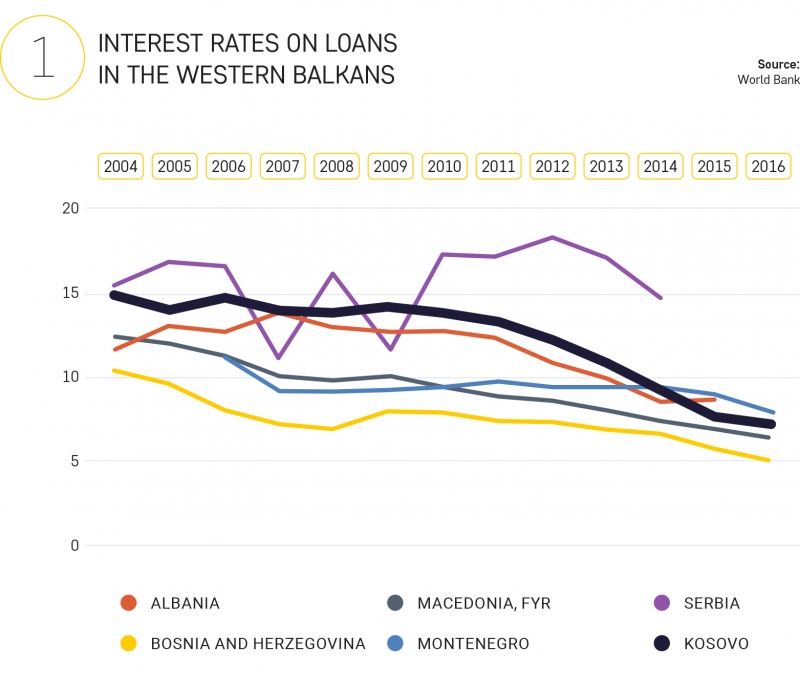

Interest rates on loans in Kosovo were continuously considered as high, both from businesses and households. However, in recent years there has been a significant improvement of financing conditions from the commercial banks in Kosovo. As shown in Figure 1, the interest rates on loans in Kosovo have continuously decreased over the past decade. Moreover this decline is the highest in the region, with over 30 percent compared to the average decline of loan interest rates in Western Balkan countries. Compared to year 2004 interest rates on loans in Kosovo have more than halved by decreasing for more than 7.5 percentage points. The interest rates on loans in Kosovo remain higher than those in Macedonia and Bosnia and Herzegovina, while being lower than those of Montenegro, Albania and Serbia. Furthermore, it should be noted that the trend of lowering interest rates in Kosovo has continued during the first half of year 2017 as confirmed by the data produced by the Central Bank of Kosovo (note: the data used in this story are taken from the World Bank in order to be comparable with other countries of the region. The data reported from this source for Kosovo are similar to those of Central Bank of Kosovo).

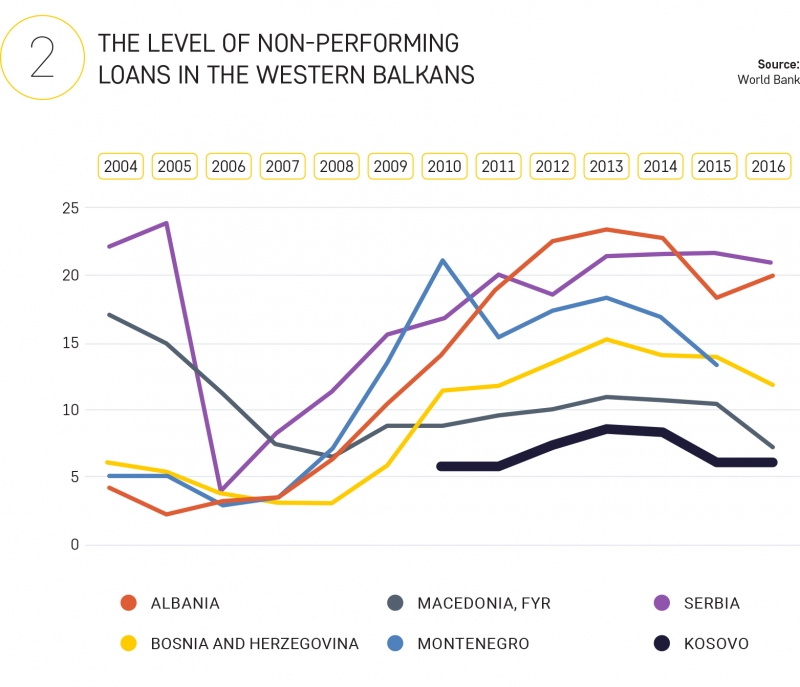

Regarding the interest rates on deposits, Kosovo has the lowest rate compared to the countries in the region, however the narrowing of the interest rate spread (i.e. the difference between interest rates on loans and deposits) was the highest during this period. The increase of precautionary measures when issuing loans, strengthening oversight mechanisms by CBK and the addition of instruments to facilitate the enforcement of contracts have resulted in the reduction of non-performing loans rate. This may also reflect customer self-selection to getting a loan and accelerated growth of loans volume. However, non-performing loans rate in Kosovo is the lowest in the region and stands at 6% (Figure 2). Also, this rate has been significantly decreased in recent years after the increase of non-performing loans rate in 2013, when it stood at 8.5 percent. Therefore, Kosovo continues to have the highest quality of loan portfolio from Western Balkan countries.

In general, the banking industry in Kosovo has significantly improved its performance by improving its main indicators. However, further improvements of the mechanisms for enforcing contracts, improving borrowers’ financial reporting, continuous decrease of the level of concentration in the industry, in addition to lowering administrative costs, would enable further improvement of the financing conditions in Kosovo.